7th Pay Commission has recommended Abolishing 52 Allowances

- Air Despatch pay

- Air Steward Allowance

- Assisting Cashier Allowance

- ASV Allowance

- Breakdown Allowance

- Cash Handling Allowance

- Coal Pilot Allowance

- Command Allowance

- Commando Allowance

- Commercial Allowance

- Condiment Allowance

- Court Allowance

- Cycle Allowance

- Desk Allowance

- Diet Allowance

- Electricity Allowance

- Entertainment Allowance for Cabinet Secretary

- Entertainment Allowance in Indian Railways

- Family Planning Allowance

- Flying Squad Allowance

- Funeral Allowance

- Handicapped Allowance

- Headquarters Allowance

- Hutting Allowance

- Investigation Allowance

- Language Reward and Allowance

- Launch Campaign Allowance

- Metropolitan Allowance

- Night Patrolling Allowance

- Official Hospitality Grant in Defence Forces

- Operation Theatre Allowance

- Organization Special Pay

- Out-Ture Allowance

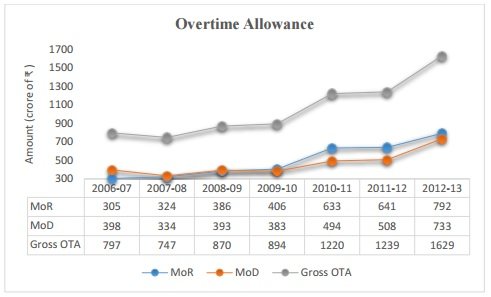

- Overtime Allowance (OTA) (pic)

- Rajdhani Allowance

- Rent Free Accommodation

- Risk Allowance

- Savings Bank Allowance

- Secret Allowance

- Shorthand Allowance

- Space Technology Allowance

- Special Compensatory (Hill Area) Allowance

- Special DOT Pay

- Special NCRB Pay

- Special Scientists Pay

- Spectacle Allowance

- Study Allowance

- Sumptuary Allowance in Training Establishments

- Sumptuary Allowance to Judicial Officers in Supreme Court Registry

- Training Stipend

- Treasury Allowance

- Vigilance Allowance

- Air Despatch Pay, Air Steward Allowance, Shorthand Allowance:-

8.3.27 Air Despatch Pay is granted to PBORs of Defence services who are employed for air dropping of supplies in forward areas. The current rate is ₹360 pm. Air Steward Allowance is granted to Group “Y” tradesmen of the Indian Air Force who are employed on board VVIP flights for steward duties. The existing rate is ₹900 pm. Shorthand Allowance is payable to PBORs of Indian Air Force and Indian Navy employed on shorthand duties. The present rate is ₹360 pm.

8.3.28 There are demands to abolish these allowances and grant alternative compensation to the affected employees.

Analysis and Recommendations

8.3.29 These allowances are paid to very few personnel of the Defence forces. The Commission is of the view that these kinds of duties are intrinsic to the related job profile and additional allowance is not justified. Accordingly, it is recommended that these three allowances should be abolished.

- Air Steward Allowance

8.2.27 (first Point Read More)

8.3.28 (first Point Read More)

8.3.29 (first Point Read More)

- Assisting Cashier Allowance

8.10.4 This allowance is granted only in the Ministry of Consumer Affairs, Food and Public Distribution, to MTS staff for assisting cashier in bringing cash from banks. The current rate is ₹90 pm

- ASV Allowance

8.10.5 This allowance is granted to Accounts Stock Verifiers of Indian Railways on Account of hardship involved in their job. The present rate is ₹ 1,000 pm.

- Breakdown Allowance

8.10.8 This allowance is granted to non-gazetted Railway servants who are earmarked for attending to breakdown duties. The present rates are:

|

Grade Pay |

Rate ( ₹ per month) |

|

Up to ₹ 1800 |

120 |

| ₹1900 |

180 |

|

₹2400 – ₹2800 |

240 |

| ₹4200 and above (limited to non-gazetted staff) |

300 |

- Cash Handling Allowance

8.10.9 It is paid to cashiers working in Central Government department, for handling of cash. The current rates are:

|

Amount of Average Monthly Cash Disbursed |

Rate ( ₹ per month) |

|

<₹50,000 |

230 |

|

Over ₹50,000 and up to ₹2,00,000 |

450 |

|

Over ₹2,00,000 and up to ₹5,00,000 |

600 |

| Over ₹5,00,000 and up to ₹10,00,000 |

750 |

| >₹10,00,000 |

900 |

- Coal Pilot Allowance

8.10.12 It is paid to Shunt men and other Group D staff of transportation Department of Indian Railways who accompany pilots in the collieries for shunting and similar other duties. The present rates are:

|

For First Trip |

₹45 per trip |

| For every Subsequent Trip |

₹15 per trip |

- Command Allowance

8.17.18 This allowance is granted to certain personnel in CAPFs for shouldering higher responsibilities at the rate of ₹100 pm. There are demands to raise this allowance five-fold.

Analysis and Recommendations

8.17.19 Not only is the amount of allowance meagre, there is no valid justification for its continuation Accordingly, it is recommended that Command Allowance should be abolished.

- Commando Allowance

8.10.14 This allowance is granted to personnel of Delhi Police who act as Commandos. The existing rates are:

|

SI |

₹100pm |

|

Head Constable |

₹75 pm |

| Constable |

₹50 pm |

- Commercial Allowance

8.17.20 Commercial Allowance is granted to Announcers, ECRCs, Commercial clerks, TCs of Indian Railways for performing certain commercial duties at the rate of ₹180 pm. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.21 The amount of the allowance is meagre and no valid justification has been provided for its continuation. Hence, it should be abolished.

- Condiment Allowance

8.17.26 Condiment Allowance is paid to those non-gazetted personnel of Defence forces and CAPFs who dine in the mess, at the rate of ₹89.78 pm. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.27 Condiment Allowance is not an allowance in the true sense of the term, i.e., it is not paid to an individual, but to the Unit for collective purchase of condiments. As such, it is proposed to abolish this allowance, and the expenditure on condiments may be termed as Condiment expenditure and should be shown as such under the relevant budget head.

- Court Allowance

8.17.32 Court Allowance is granted to Legal Officers in National Investigation Agency (NIA) to meet the miscellaneous expenditure incurred in court. The present rates are ₹1,500 pm to Public Prosecutor and Sr.Public Prosecutor, and ₹2,000 pm to Dy.Legal Advisor. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.33 The Commission does not find the allowance justified. Hence, it is recommended that it should be abolished.

- Cycle Allowance

8.15.10 It is paid where the duties attached to the post require extensive use of bicycle and the official concerned has to use and maintain his own cycle for official journeys. The existing rate is ₹90 pm. No demands regarding Cycle Allowance have been received.

Analysis and Recommendations

8.15.11 The Commission is of the view that amount of this allowance is meagre and the allowance itself is outdated. Hence, it should be abolished.

- Desk Allowance

8.17.38 Desk Allowance is granted to Desk Officers in CSS and other HQ services at a rate of ₹900 pm. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.39 This allowance is virtually non-existent since 2010 and there are very few instances of its payment now. Besides no valid justification has been provided in support of this allowance. Thus, it is recommended that Desk Allowance should be abolished.

- Diet Allowance

8.17.40 Diet Allowance is granted to deputationists in Bureau of Immigration as compensation for food, at a rate of ₹200 pm. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.41 The amount of the allowance is meagre and no valid justification has been provided for its continuation. Hence, it is recommended that the allowance should be abolished

- Electricity Allowance

8.17.46 Personnel belonging to the Defence Forces are permitted reimbursement of electricity charges for the first 100 units of electricity. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.47 This allowance is petty in nature and with the increase in pay proposed, there is no justification for its continuation. Hence, it should be abolished.

- Entertainment Allowance

8.13.3 An Entertainment Allowance of ₹10,000 pm is granted to Cabinet Secretary to entertain distinguished visitors.

- Entertainment Allowance in Indian Railways

8.13.4 Similar allowance is granted to officers of Indian Railways also, the existing rates of which are as under:

|

(₹ per annum) |

|

|

PHOD |

6000 |

|

DRM |

6000 |

|

CWM |

5000 |

| SAG |

4500 |

|

SG/JAG |

2500 |

| STS (Independent Charge) |

2000 |

|

STS |

1600 |

| JTS |

1000 |

- Family Planning Allowance

8.17.48 Family Planning Allowance (FPA) is granted to Central Government employees as an encouragement to adhere to small family norms. The existing rates are as under:

|

Grade Pay |

(₹ per month) Family Planning Allowance

|

|

1300-2400 |

210 |

|

2800 |

250 |

| 4200 |

400 |

|

4600 |

450 |

| 4800 |

500 |

|

5400 |

550 |

| 6600 |

650 |

|

7600 |

750 |

| 8700 |

800 |

|

8900 |

900 |

| >10,000 |

1000 |

8.17.49 There are demands to make it equal to one increment. Representations have also been received requesting that the allowance should be double for those employees who adopt family planning norms after just one child.

Analysis and Recommendations

8.17.50 The Commission recognizes the fact that most of the benefits related to children, viz.,Children Education Allowance, Maternity Leave, LTC, etc., are available for two children only. Moreover the level of awareness regarding appropriate family size has also gone up among the government servants. Hence, a separate allowance aimed towards population control is not required now. Accordingly, it is recommended that Family Planning Allowance should be abolished.

- Flying Squad Allowance

8.10.21 It is paid to Chief Ticket Inspectors (CTIs) and Travelling Ticket Examiners (TTEs) of Indian Railways who are part of the Flying Squads constituted for surprise ticket checking in trains. The current rate is ₹300 pm.

- Funeral Allowance

8.17.53 When death of an employee occurs in peace areas, a funeral allowance of ₹6,000 is granted and mortuary charges are reimbursed to Defence personnel. Demands have been received to extend that allowance to all civilian employees and for a four-fold increase in rates.

Analysis and Recommendations

8.17.54 The Commission is of the view that with the pay raises provided by successive Pay Commissions, this kind of an allowance has lost its meaning. Hence, it is recommended to be abolished.

- Handicapped Allowance

8.10.23 It is a conveyance allowance granted to differently abled employees in Indian Railways. This allowance is granted to employees who are visually challenged, orthopedically challenged and staff suffering from spinal deformity. The present rate is 5 percent of Basic Pay, subject to a maximum of ₹100 pm.

- Headquarters Allowance

8.10.25 It is granted to officers of Organised Group `A’ Service in DOT and certain other ministries upon posting at headquarters. The existing rate is ₹225 pm.

- Hutting Allowance

8.7.28 This allowance is granted to Railway servants living outside Railway premises who, for the outbreak of plague in epidemic forms, are compelled to vacate their houses and to erect temporary huts on Railway land or elsewhere. The present rate of the allowance is ₹100 pm. No demands have been received regarding this allowance.

Analysis and Recommendations

8.7.29 The allowance is outdated. It is recommended for deletion.

- Investigation Allowance

8.17.62 Investigation Allowance is granted in Serious Fraud Investigation Office, Ministry ofCorporate Affairs, to attract talent pool from other ministries. The existing rates are as under:

|

Grade Pay |

Rate ( ₹ per month) |

| 8700 | 2000 |

| 6600 | 1400 |

| 5400 | 1400 |

| 4800 | 1400 |

Analysis and Recommendations

8.17.63 There is no justification for continuation of this allowance. Accordingly, it is recommended that the allowance should be abolished.

- Language Reward and Allowance

8.9.39 This allowance is payable to MEA officers who have learnt optional foreign language when posted in the region where the language is main language or widely used. The present rate varies from ₹100 pm for being “proficient” to ₹200 pm for being “above proficient.” No demands have been received regarding this allowance.

Analysis and Recommendations

8.9.40 The amount of the allowance is meagre. Hence, it should be abolished.

- Launch Campaign Allowance and Space Technology Allowance

8.17.67 Space Technology Allowance is granted to supporting scientific and technical staff in DOS/ISRO in recognition of the need for their retention and keeping in view the fact that they play a crucial role in the success of every mission. Considering that all missions/projects of ISRO are implemented in campaign mode and all categories of employees have to work with extra vigour, it was decided to give a lump sum Launch Campaign Allowance to all administrative staff working in DOS/ISRO to appreciate and recognize their contribution to ISRO. Both the allowances are paid at the identical rate of ₹7,500 per annum. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.68 The allowances are in the nature of an appreciation allowance. Since PRIS has already been implemented in ISRO, there is no justification for the continuation of these allowances. Hence it is recommended that both these allowances should be abolished.

- Metropolitan Allowance

8.10.33 This allowance is granted to personnel of Delhi Police on account of hardship faced in a Metropolitan area. The present rates are:

| Sub-Inspector (SI) | ₹180 pm |

| Constable, Head Constable, ASI | ₹120 pm |

- Night Patrolling Allowance

8.10.34 It is granted to Trackmen of Indian Railways to compensate for hardship faced in Night Patrolling. The present rate is ₹10 per night of patrolling.

- Official Hospitality Grant in Defence Forces

8.13.5 In the Ministry of Defence, this allowance goes by the name of Official Hospitality Grant, with the following rates:

|

(₹ Per Month |

|

| Service Chiefs/VCs/Army Cdrs | 3000 |

| Leftinent General | 2400 |

| Major General | 1800 |

| Brigadier | 1500 |

| Cos of a Ship-Captain Rank | 1200 |

| Naval Officer-in-Charge/CO up to Cdr | 600 |

- Operation Theatre Allowance

8.10.35 This allowance is granted to 35 percent of the Staff Nurses in Central Government Hospitals, who work in ICU/Operation Theatres. The current rate is ₹240 pm.

- Organization Special Pay

8.10.36 It is granted to certain categories of personnel in ITBP in view of the arduous nature of job. The extant rates are:

|

(₹ Per Month) |

|

| Subedar (senior) | 100 |

| SM/Inspector | 100 |

| Sub-Inspector | 60 |

| Head Constable | 40 |

| Lance Naik/Naik | 40 |

| Constable | 30 |

- Out-turn Allowance

8.10.37 This allowance is granted to Telegraph Signaller/Tele printer Operator/Wireless Operators in Indian Railways as a remuneration for per message worked in excess of the specified number of messages during the normal duty hours on a nominated circuit. The current rates are:

|

Post |

No. of Minimum Messages |

|

| ₹ 0.10 for each message in excess of 250 messages handled over the minimum number of messages sent or received in eight of six hour shift. | Telegraph Signaller | 100 |

| Telegraph Operator | 250 | |

| Wireless Operator Link (Two Stations) | 80 | |

| Wireless Operator Net (> Two Stations) | 60 |

- Overtime Allowance (OTA)

8.17.89 Overtime Allowance (OTA) is granted to government employees for performing duties beyond the designated working hours. Presently, OTA is paid in several ministries/ departments, up to a certain level, at varying rates.

8.17.90 JCM-Staff Side has demanded that OTA should be paid to all government employees who are asked to work beyond office hours, on the basis of actual Pay, DA and Transport Allowance.

Analysis and Recommendations

8.17.91 Out of the total expenditure on OTA in Government of India in 2012-2013, over 90 percent is on account of just two ministries: MoR – Ministry of Railways and MoD – Ministry of Defence (Civilian employees). The Commission compared the OTA expenditure in these two ministries over the period 2006-07 to 2012-13.

8.17.92 In both the ministries, the amount of OTA is showing a rising trend.

8.17.93 The absolute numbers and amounts are as given below:

OTA and Pay (including DA) in MoR and MoD (Civilian Employees)34

| 2006-07 | 2012-13 |

CAGR of OTA |

CAGR of Pay |

|||||

| OTA | Pay |

(A)/(B) |

OTA | PAY |

(X)/(Y) |

|||

| (A) | (B) | (X) | (Y) | |||||

| MoR | 304.88 | 14563.01 | 2.09% | 791.65 | 30713.98 | 2.58% | 17.24% | 13.24% |

| MoD | 398.15 | 5035.94 | 7.91% | 732.73 | 1121.9 | 6.54% | 10.70% | 14.27% |

8.17.94 There are two noteworthy points here:

- While OTA as a percentage of Pay is declining in MoD (6.54% in 2012-13 compared to 7.91% in 2006-07), it is on the rise in MoR (2.58% in 2012-13 compared to 2.09% in 2006-07).

- The Compound Annual Growth Rate (CAGR) of OTA (17.24%) in MoR exceeds even the CAGR of Pay (13.24%), or in other words, OTA is rising faster than pay.

8.17.95 This clearly shows that while MoD has achieved some success in its efforts to control OTA, the efforts of MoR have not yielded the desired results. However, at the same time, it should also be kept in mind that OTA as a percentage of pay is already much higher in MoD compared to MoR.

8.17.96 The Commission also took note of the recommendations of the III, IV, V and VI CPCs that OTA should be abolished except where it is a statutory requirement. However, it is also a fact that despite these recommendations, OTA continues to be paid to certain categories of staff (at rates that are quite old) even when it is not a statutory requirement.

8.17.97 Hence, while this Commission shares the sentiments of its predecessors that government offices need to increase productivity and efficiency, and recommends that OTA should be abolished (except for operational staff and industrial employees who are governed by statutory provisions), at the same time it is also recommended that in case the government decides to continue with OTA for those categories of staff for which it is not a statutory requirement, then the rates of OTA for such staff should be increased by 50 percent from their current levels.

8.17.98 A stricter control on OTA expenditure is also suggested.

- Rajdhani Allowance

8.10.41 It is granted to Train Superintendent (TS) and Deputy Train Superintendent (Dy.TS) of Rajdhani Express Trains in Indian Railways, due to harder nature of their jobs. The current rate is ₹900 pm for TS and ₹360 pm for Dy.TS.

- Rent Free Accommodation

8.7.32 This allowance is granted to IB personnel on confrere (a fellow member of a profession, fraternity, etc.) basis, if admissible to police personnel of equivalent rank at that station. No demands have been received regarding this allowance.

Analysis and Recommendation

8.7.33 The Commission opines that the allowance is outdated. Hence, it is recommended for deletion

- Risk Allowance

8.10.42 Risk Allowance is presently given to employees engaged in hazardous duties or whose work will have deleterious effect on health over a period of time. Risk Allowance is also paid to Sweepers and Safaiwalas engaged in cleaning of underground drains, sewer lines as well as to the employees working in trenching grounds and infectious diseases hospitals. The extant rate is ₹60 pm.

- Savings Bank Allowance

8.10.43 In Department of Posts, granted to Postal Assistants working in Post Office Savings Bank (POSB) for shouldering strenuous and complicated nature of Savings Bank work. Postal Assistants need to qualify an Aptitude Test to get this allowance. The current rates are ₹300 pm for fully engaged staff and ₹150 pm for partially engaged staff.

- Secret Allowance

8.10.46 This allowance is granted in Cabinet Secretariat, for dealing with Top Secret papers and performing sensitive and arduous nature of duty. It is paid as a flat sum per month based on the post held by the concerned official.

- Shorthand Allowance

8.3.27, (First Point Read More)

8.3.28. (First Point Read More)

8.3.29 (First Point Read More)

- Space Technology Allowance

8.17.67 (twenty-six Point Read More)

- Special Compensatory (Hill Area) Allowance

8.10.48 It is granted to Central Government employees posted at Hill stations 1000 metres or more above sea level. The present rates are:

|

Grade Pay > ₹ 5400 |

Others |

|

₹900 Pm |

₹720 pm |

- Special DOT Pay

8.3.25 This allowance, at the rate of ₹400 pm, is granted to DOT officers for shouldering higher responsibility. No demands have been received regarding this allowance.

Analysis and Recommendations

8.3.26 The Commission does not find the continuation of this allowance justified. Hence, it is recommended that this allowance should be abolished.

- Special NCRB Pay

8.17.123 Special NCRB Pay is granted to Assistant Director in C&S division and Deputy Superintendent (Finger Print) in Central Finger Print Bureau of National Crime Records Bureau, on the premise that the feeder posts of both the above mentioned posts lie in the same GP which is an anomaly. A proposal to upgrade the post of Assistant Director to GP 7600 and that of Deputy Superintendent (Finger Print) to GP 5400 (PB-3) has been sent to VII CPC. Until then, the Bureau has itself taken steps to sort out this “pay anomaly” by providing this allowance of ₹800 pm.

Analysis and Recommendations

8.17.124 The merger of certain V CPC pay scales by the VI CPC, led to similar situations in many cadres in which some posts and their feeder posts came to be in the same GP. The resolution to this has not been in the form of any such allowance. In fact, in many such cases there has been no resolution, as we have seen in the memoranda received. In this context, the presumption by NCRB that this constitutes an “anomaly,” to be “rectified” through an allowance is incorrect. Hence it is recommended that this pay should be immediately stopped.

- Special Scientists Pay

8.17.125 Special Scientists’ Pay, at a rate of ₹4,000 pm, is granted to Scientists/Engineers H with GP 10000 because it was felt that the pay scale accorded to them by the V CPC was not commensurate with their status and was adversely affecting their morale. No demands have been received regarding this pay.

Analysis and Recommendations

8.17.126 Since the V CPC recommendations, much time has passed and the pay scales of all employees have been revised upwards. There is no rationale for the continuation of this allowance. Hence, it is recommended that this allowance be abolished.

- Spectacle Allowance

8.17.130 Spectacles are issued free to those Defence Forces personnel in whose case impairment of vision is either attributable to service or their sight is so defective that it interferes with their efficiency. When spectacles are not issued, reimbursement is permitted in the form of Spectacle Allowance, at the following rates:

| For Spectacles with normal lenses | ₹ 130 |

| For Spectacles with bifocal lenses | ₹ 250 |

8.17.131 There are demands that the Spectacle Allowance should be abolished and adequately compensated in Composite Personal Maintenance Allowance.

Analysis and Recommendations

8.17.132 The amount of this allowance is meagre. Hence, it is recommended that this allowance should be abolished.

- Study Allowance

8.17.135 Study Allowance, ranging from 1 to 2.75 Pound (Sterling) per day, is granted to a government servant who has been granted study leave for studies outside India, for the period spent in prosecuting a definite course of study at a recognized institution or in any definite tour of inspection of any special class of work as well as for the period covered by the examination at the end of the course of study. This allowance has been referred by the government to VII CPC for consideration.

Analysis and Recommendations

8.17.136 The rate of this allowance is meagre and not revised since 1972. Accordingly, it is recommended that the allowance should be abolished.

- Sumptuary Allowance in Training Establishments

8.13.6 There exists a Sumptuary Allowance in National/Central Training Establishments for Group `A’ Officers, meant for entertaining small groups of students and faculty. The existing rates are:

| For Director or Head | ₹3500 pm |

| For Course Directors | ₹2500 pm |

| For Counsellors | ₹2000 pm |

- Sumptuary Allowance to Judicial Officers in Supreme Court Registry

8.13.7 Judicial Officers on deputation in the Supreme Court Registry are also granted a Sumptuary Allowance at the same rate as what they were getting in the parent office.

- Training Stipend

8.17.139 Non Gazetted Officers of Delhi Police, while undergoing training, are entitled for Training Stipend at the rate of ₹80 pm.

Analysis and Recommendations

8.17.140 The stipend is meagre. Hence, it is recommended that Training Stipend should be done away with.

- Treasury Allowance

8.10.57 This allowance is granted in Department of Posts to Treasurers and Assistant Treasurers working in Head Post Offices and large sub offices for handling of cash. The present rate is ₹360 pm for handling cash up to ₹2 lakh and ₹480 pm for handling cash more than ₹2 lakh.

- Vigilance Allowance

8.17.141 A Vigilance Allowance of ₹2,500 pm is granted to Vigilance Inspectors in Indian Railways to attract experienced and talented staff.

Analysis and Recommendations

8.17.142 The Commission took note of two aspects regarding this allowance:

- This allowance is paid only in Railways while there are posts of Vigilance Inspectors under other ministries as well.

- No supporting evidence has been submitted by the Ministry of Railways to show that

- Employees were unwilling to join the vigilance organization before the commencement of this allowance, and

- The position has improved after this allowance was introduced.

8.17.143 In such a situation, the Commission recommends abolishing this allowance

7th Pay Commission Report Download Click here

Continue read: 7th Pay Commission

Continue read: 7th Pay Commission Highlights

Continue read: 7th CPC Pay Calculator as per 7th CPC recommended

A N G says

family planning allowance for existing beneficiaries be continued. Because sentiments of Husband & Wife were involved while taking decision of going for family planning. In many cases this money is given by the husband to his unemployed wife. Besides half percent rebate on interest on loan taken from Government for Housing is also available for adopting small family norms. This is sort of incentive given to make small family happy. Small family was the need of hour in olden times. Those who have responded to this scheme announced by the Government should be rewarded till they retire. It may be abolished only in case of new entrants to the service or to the scheme as the things have changed now. All to gether an amount equal to 2 increments may be given instead of fixed amount. ( One for compensating to family planning allowance and 2 nd for compensating to half percent rebate on H B A. Half percent rebate on interest on H B A which is available at present may also be abolished as the calculation is complicated.

Animesh Mahata says

I have a doubt about 7th CPC recommendation regarding 52 types of allowances to abolish. Whether it has retrospective effect for all who are getting such allowance or only will be effected and abolished from 01/01/2016 .Please clarify.

BOMMAKANTI SRINIVAS says

Sir,

I have a doubt regarding the Children Education Allowance.

As per the VI CPC the C.E.A. is applicable for the first two surviving children only.

What about the VII CPC recommendation?

Please clarify.